Incremental margin calculation

The incremental revenue is. As a result the total incremental cost to produce the additional 2000 units is 30000 or 330000 - 300000.

How To Master Data Visualization Data Visualization Data Visualization Techniques Visualisation

The calculation of incremental cost shows a change in costs as production expands.

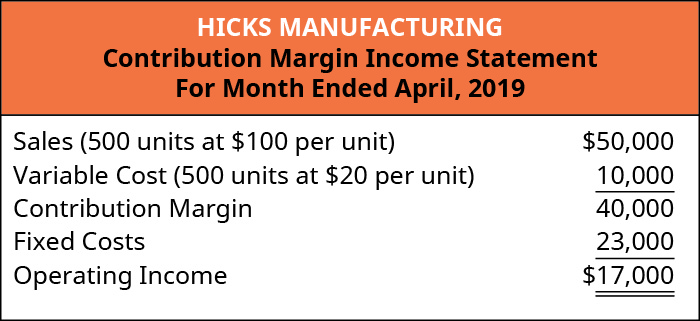

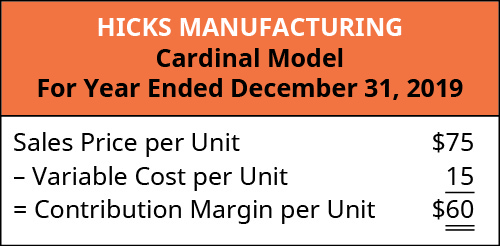

. In addition the amount of the limited capacity each product uses must be determined. Step by Step calculation. Based on this information the contribution.

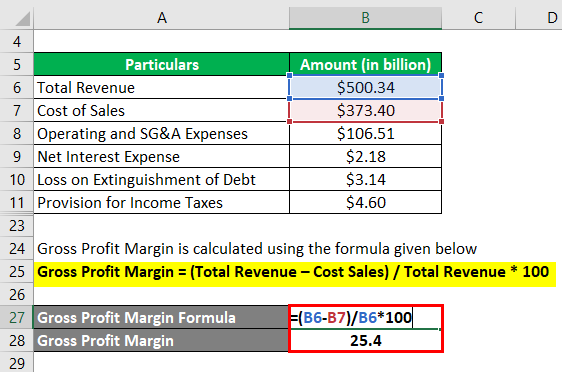

You calculate your incremental cost by multiplying the number of smartphone units by the production cost per smartphone unit. When you want to calculate the incremental portion of EBITDA you take the difference between two periods. Total cost of producing two items - the total cost of producing one item.

The formula to calculate incremental cost is as follows. Incremental Margin means one half of one percent 050 at all times during 4FQ03 and at all other times during each other fiscal quarter during the Incremental Margin Period a zero 0. Incremental Revenue refers to the value of additional revenue of the company during the period under consideration if there is a change in sales quantity.

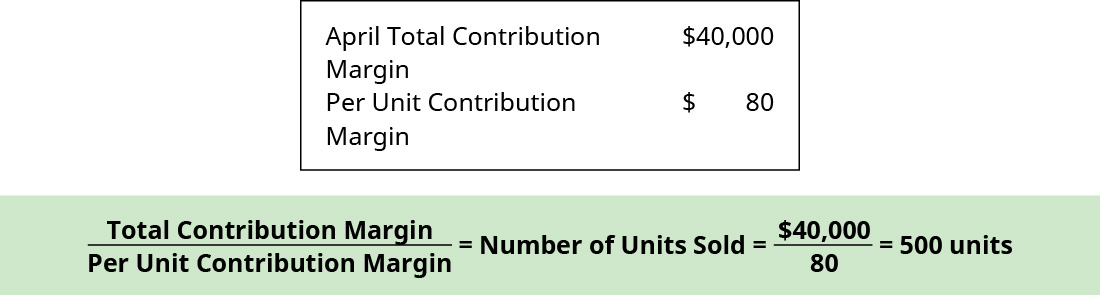

To maximize profit a calculation of the contribution margin for each product is required. As a result in this. Incremental Cost Of Capital.

For example the production cost of a standard 100 units for a business is known but. Start Value of Start Value. Start Value 100 Percentage Increase from 1 to 100 100 Increase By 1 10100.

The salesman who completed the deal will receive a 2000 commission so the aggregated amount of all variable costs is 42000. If they wanted to look at the incremental revenue they might track the profits from 70 additional car sales. How To Calculate Marginal Revenue.

Incremental operating margin is the increase or decrease of income from continuing operations before stock-based compensation interest expense and income-tax expense between two. A companys incremental operating margin is calculated as the change in operating income divided by the change in revenue over a period. The incremental cost per unit equals 15 30000 2000.

Gross Margin 38. How to calculate incremental cost. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management.

Stocks Markets Personal. Remember you shouldnt include previous expenditures in the calculation so consider only costs directly related to the decision at hand. An example would be a company had EBITDA of 220MM in.

A term used in capital budgeting the incremental cost of capital refers to the average cost a company incurs to issue one additional unit of debt.

7 1 Exploring Contribution Margin Financial And Managerial Accounting

Profit Margin L Most Important Metric For Financial Analysis

7 1 Exploring Contribution Margin Financial And Managerial Accounting

How Do I Calculate An Ebitda Margin Using Excel

The Impact Of Discounting On Your Margins Complete Financial Training

Incremental Margin Formula And Profit Growth Analysis Calculator

7 1 Exploring Contribution Margin Financial And Managerial Accounting

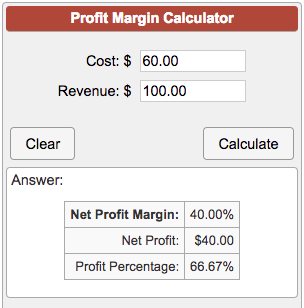

Profit Margin Calculator

Contribution Margin Formula And Ratio Calculator Excel Template

Difference Between Breakeven Point Vs Margin Of Safety Financial Analysis Money Management Advice Money Strategy

Performance Profits How To Calculate Your Small Business S Margin Mila Lifestyle Accessories

Incremental Margin Formula And Profit Growth Analysis Calculator

How Does Gross Margin And Net Margin Differ

Contribution Margin Formula And Ratio Calculator Excel Template

2021 Cost Benefit Analysis Fillable Printable Pdf Regarding Project Management Cost Benefit Marketing Strategy Template Analysis Business Continuity Planning

Contribution Margin Formula And Ratio Calculator Excel Template

Margin Of Safety Formula Guide To Performing Breakeven Analysis